Jebsen Fine Wines spoke to DecanterChina.com for our exclusive interview series on life inside China’s wine trade. Topics include Hong Kong versus free trade zones in China, Bordeaux en primeur and China’s changing market.

Free trade zones: a threat to Hong Kong as a wine hub?

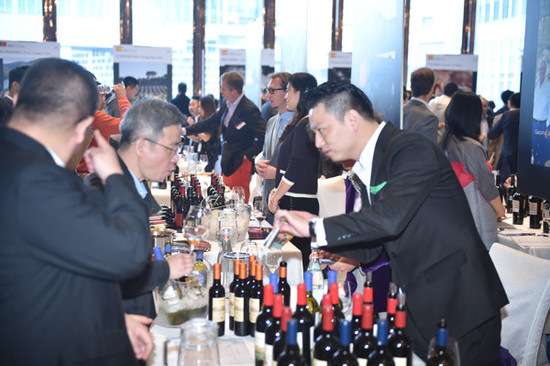

Established in Hong Kong in 1991, Jebsen Fine Wines is one of Greater China’s largest independent wine and spirits importers. Now the company holds offices in Hong Kong, Macau and Mainland China.

In recent years, China has launched several experimental free trade zones. Many wine producers are keen to explore the benefits in storing wines off-bound in warehouses located in these free trade zones.

Importers, on the other hand, are curious yet cautious about the possible impacts these free trade zones may bring to the trade.

Trade analysis warns that Hong Kong is facing challenges as one of the key gateways for wines to enter Mainland China.

Related articles:

Wines in a cave: Alternative route for wines to China

Tianjin Free Trade Zone to build a wine warehouse and trading hub

Gavin Jones, director of Jebsen Fine Wines, doesn’t see these experimental free trade zones as a threat to Hong Kong.

‘A diversification of market channels can help enrich product variety, in turn helping consumer education,’ said the director.

‘Hong Kong has such a rich wine industry, supported with excellent infrastructure and a proven track record. In addition, with zero taxes, it makes the fluid movement of products around the region possible.’

The beneficial policies offered by the CEPA (Hong Kong Closer Economic Partnership Arrangement) also mean that wines can get into Mainland China with more ease, he said.

Related article:

New deal set to improve wine trade between Hong Kong and Mainland

However, parallel imports, which means products imported without the permission of the intellectual property owner, is and will remain a problem for Hong Kong, warned Jones.

‘Free Trade Zones in China will still be strictly regulated and thorough documentation will always be required. As such, I think the greater risk of parallel remains via Hong Kong.’

He added that to halt the flow of parallel stocks around the globe requires joint efforts of brand owners and their representatives.

The Mainland and Hong Kong comparison

‘The rise of the middle-class consumer is changing the playing field significantly in Mainland China’, said Jones.

As more Mainland Chinese consumers are buying wines to drink rather than giving them away as gifts, wines priced between RMB100-RMB300 are sold especially well for the importer in Mainland China.

The change happens not only in the tier-one cities, said Jones. ‘The Greater China market has diversified and is more dynamic than ever. This is leading to market fragmentation where there are largely varying consumer habits across tier-one to tier-five cities and no one-size-fits-all solution.’

Related article:

Top 10 sources of imported wines in China: The half year report

For the more mature Hong Kong market, ‘demand ranges from easy-to-drink value to Grand Crus Classe First Growths,’ said Jones.

‘With zero duties, the consumer has the luxury of enjoying very well made wines at less than HK$100 per bottle.’

In addition, experienced diners are seeking specialised food and beverage pairings, which has inspired Jebsen Fine Wines to launch a series of Japanese sake brands.

Similar to the Mainland, France remains the top source of imported wine for Hong Kong. Australia and USA are in the race for second place in HK, while the Mainland consumers are more interested in affordable choices from Chile and Spain.

‘With the right level of long term commitment and investment from the brand owners’, Californian wines may be the next trending region in Hong Kong, predicted Jones.

From importer to brand owner

Besides the brands represented by Jebsen Fine Wines (including Champagne Bollinger and Marchesi de Frescobaldi), the company is also running its own wine brands under Jebsen Wine Estates through investing in wineries and vineyards around the world.

The main aim is to ‘diversify’ the portfolio, said Jones.

‘The agency brands that Jebsen Fine Wines represent and the brands that Jebsen Wine Estates own complement each other. This is Jebsen’s strategy – to diversify its portfolio beyond the traditional brands-under-representation model and to give consumers different wine choices that fit their lifestyle aspirations. ’

Bordeaux en primeur in Greater China

After 20 years’ commitment in en primeur, ‘like many of our contemporaries, we have reduced our levels of commitment (on Bordeaux en primeur) in recent years and put increased effort on investing in building the branded wines we carry,’ said the director.

‘There are some encouraging signs that prices of Bordeaux are firming and in fact, increasing. We need time to evaluate whether this is as a result of the weakening Pound Stirling.’

All rights reserved by Future plc. No part of this publication may be reproduced, distributed or transmitted in any form or by any means without the prior written permission of Decanter.

Only Official Media Partners (see About us) of DecanterChina.com may republish part of the content from the site without prior permission under strict Terms & Conditions. Contact china@decanter.com to learn about how to become an Official Media Partner of DecanterChina.com.

Comments

Submit